How You Benefit from Giving to Charity

Charity comes in many forms, but one of the most effective and simple ways of giving back is to donate time or money. Giving to nonprofit organizations can benefit you as a person in a variety of ways that you may not have considered—especially if you make use of modern technology like donation apps.

1. Become Part of the Solution

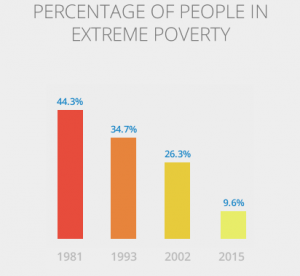

Source: The Life You Can Save

When you donate your time or money, you become part of something bigger that has meaning and purpose. Even if you can’t give large quantities of money, consider the impact small donations from thousands of people can have.

Thanks to donors all over the world, poverty is in a steep decline, falling to less than half its level in the 1990s. In fact, the United Nations reports that over 1 billion people have been saved from extreme poverty since 1990.

Your giving doesn’t have to only benefit people in impoverished foreign countries. If you donate to charitable organizations in your local community, you and your loved ones can benefit directly from their work and the resulting improvements.

2. See Things from a New Perspective

When you start giving your time and money to a cause, it helps you put some things into perspective. It’s amazing how many people benefit from something so simple as donated clothing. When you have an abundance of things, sharing helps you take care of others and not focus on yourself. It enhances and strengthens your capacity to love.

Not only does giving generally make you a happier person, but seeing the needs of the less fortunate can also make you more grateful for the blessings you have in your life.

3. Set a Good Example

If you have children or act as a role model in some capacity, your behavior can mold and shape the behavior of others. Kids, whether they be related to you or not, are very impressionable. They desire to be more like their role models, and that’s why they watch what you do and say so closely

Emulating a grateful heart and a passion to care for others will provide a foundation that will last throughout their lives. What better impact can you have than influencing the next generation in a positive way?

4. Deduct Gifts from your Taxes

Did you know that if you make charitable donations to certain organizations, you can deduct the amounts from your taxes? To make sure you benefit from every contribution you make, keep track of every donation so you can record them on your taxes at the end of the year. These tips will help you make sure you receive all the potential tax benefits of giving:

- Make sure your donations count. If you donate to an individual, it won’t. Make sure you are selecting an organization that is recognized as a charitable donation expense where you can claim a deduction.

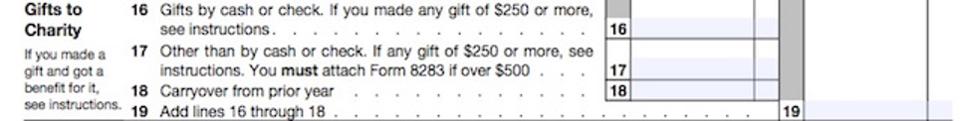

- Itemize your deductions on lines 16-19 of Schedule A on your federal form 1040.

- Don’t forget the receipt. To make sure all of your donations are deducted on your taxes, ask for a receipt for every charitable donation you make – even for those made in cash. The receipt needs to include the date, the amount of the donation, and the receiving organization’s name.

- Make sure you donate by December 31 to put it on your taxes for that year.

Track Your Giving with Donation Apps

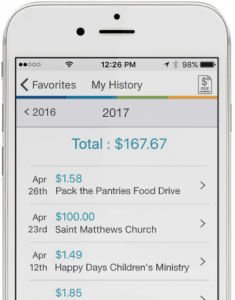

If you donate often, whether through direct contributions or payroll deductions, things can get a little hectic when trying to keep track of everything. Using donation apps like Givelify can make things simple. All your donations made through the app are automatically recorded, and you can access them at any time. This can come in very handy during tax time.

While there are a few donation apps on the market, Givelify ensures that you can make your donations without hassle or worry. With features like a point by point donation history and automatic donation receipts, you can easily keep things organized and take your generosity to the next level.